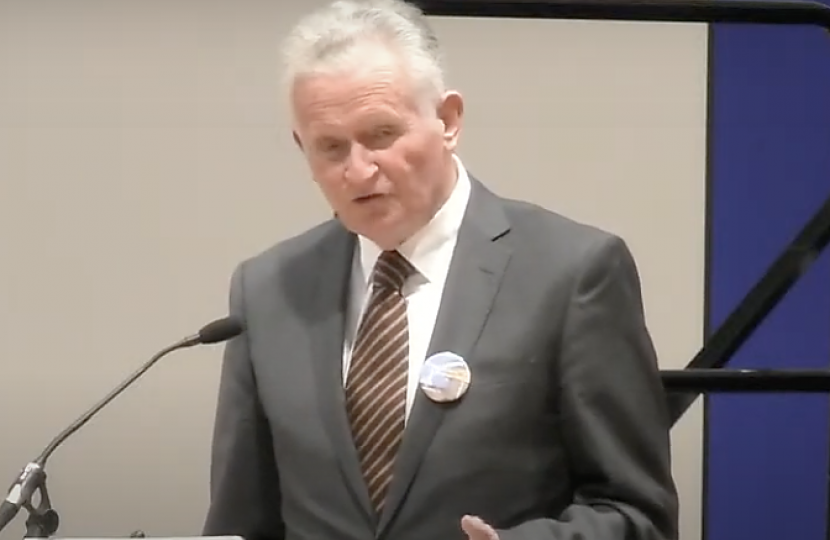

Speaking at Eastbourne Borough Full Council meeting tonight ( 26th July 2023), Conservative leader Cllr Robert Smart highlighted the authorities perilous financial position.

Cllr Smart referred to an agenda supplement including 22 pages of the Treasury Management report and asked "Why this wasn’t delivered on time (a week earlier) is a sign of unacceptable administrative sloppiness. Particularly as the text hadn’t changed for weeks!

Drawing attention to paragraphs 1.1 to 1.6, which he said proudly summarise reports on treasury management activities of the Council through the year, including the “..responsibility on members for the review and scrutiny of treasury management policy and activities.”

Oh how rosy it all looks! There is a wealth of tangential but erudite sounding complexity.

But what of the substance? The clue is to be found in paragraph 5.2: “Market” debt included in “Total debt” is apparently ZERO!

So total debt apparently reduces over the year from £119m to £113m. Oh wouldn’t that be wonderful.

But “market” debt at the beginning of the year was an additional £41m in total debt of £160m.

The Treasury Report in February estimates “new borrowing” of £6m. in the year. But what is this “market debt” and “new borrowing”?

It is short-term debt borrowed from other cash rich local authorities, typically for periods of several months.

But there is NO REPAYMENT PLAN for this short-term borrowing which is at “market” rates.

Put it like this: Its like a house purchase with a 70% longterm mortgage but the residual 30% paid for on credit cards which have to be continually rolled over at variable “market” rates!

So during the year the £5.5m of mortgage repayments were effectively paid for on the credit card!

The maturity structure of the debt portfolio shown in paragraph 5.3 completely ignores £47m of short term debt maturing within 12 months!

And the exposure to “variable” rates is shown as ZERO in paragraph 5.3.

Amongst my many unanswered questions include a question about the most recent interest rates on these short term rollovers. What rates are they?

How much interest was paid in the last financial year?

Over £4m? Compared to Council tax of £9m?

Of course if the basics of cash flow reporting were in place some of these figures would be available for scrutiny.

Last week at Cabinet I asserted that there was an absence of financial control in an organisation that couldn’t estimate its annual costs within 20%, two months before the year end.

This week I assert that an organisation which fails to report 30% of its debt (and the worst part of its debt) is out of control.

But wait a minute: The minute says that members of Cabinet considered and approved this report! Who are these Cabinet members?

Did not one single Cabinet member read it or understand it enough to see the omission?

Did neither the Cabinet Member for Finance nor the Council Leader recognise that total debt is £160m, not £47m less?

This Cabinet is clearly not fit for purpose and perhaps the proposer and seconder of this motion should resign.

We are asked to vote on this report. I ask each Councillor to consider their individual response: How can you possibly vote for a report so materially flawed that omits reference to 30% of the debt, and the worst debt with unanswered questions at that. Consider your own personal credibility,

Don’t blindly support a clearly flawed report, he urged fellow councillors